Built for the Next Generation of Family Offices

Built for the Next Generation: The Fastest-Growing Family Office Software

With a design rooted in clarity and purpose, every feature enhances strategic capability. MyFO transforms complexity into intuitive tools that exceed expectations.

We invite you to immerse yourself in the experience.

Why Choose Us?

.avif)

.avif)

.avif)

Product Features

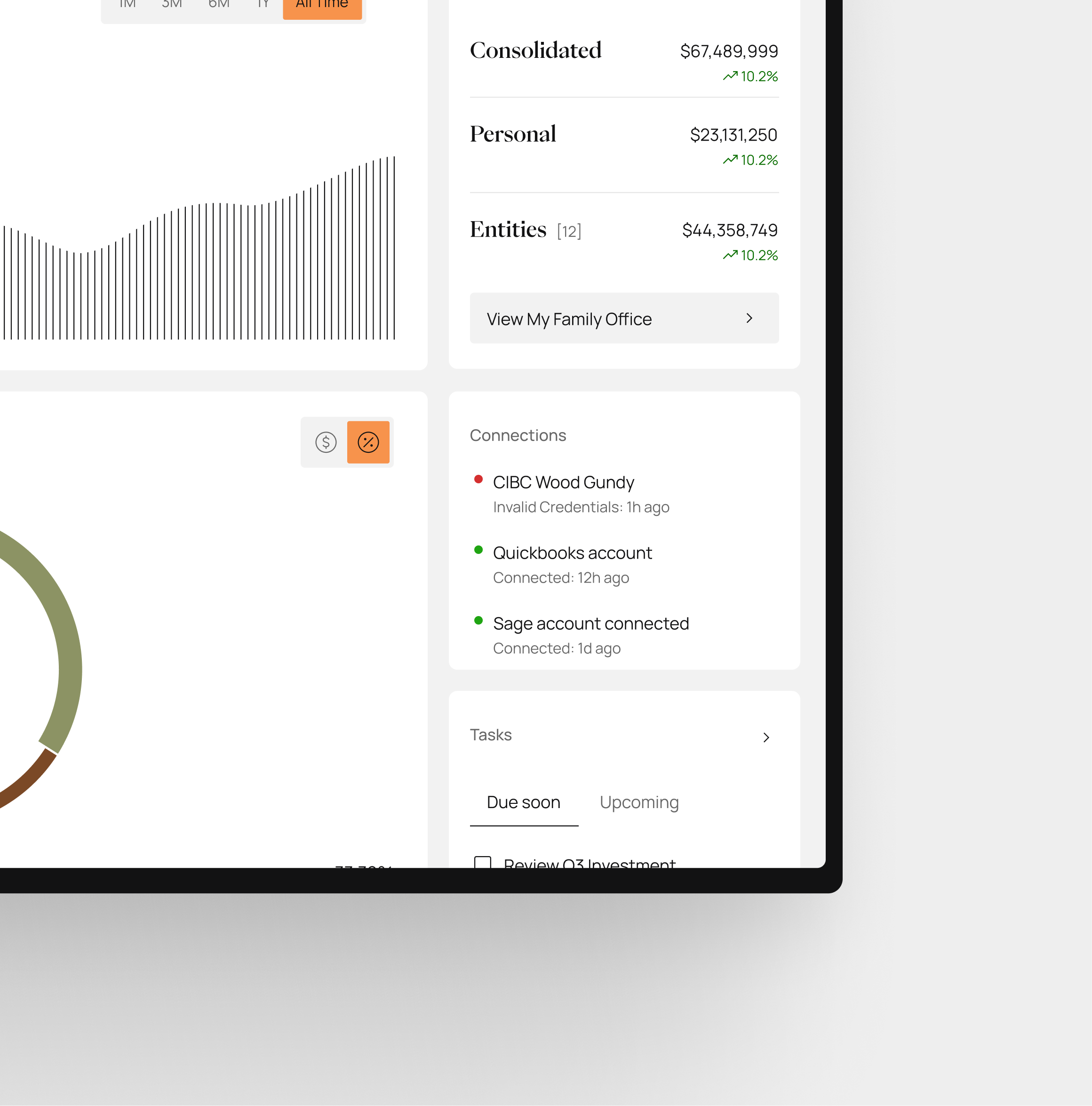

Generate comprehensive reports at both consolidated and individual asset levels with single-date or comparative analysis across time periods. View detailed breakdowns by asset class, currency, geography, and other key metrics with visual charts and tables. Export professional reports for family members and advisors for enhanced alignment across all stakeholders.

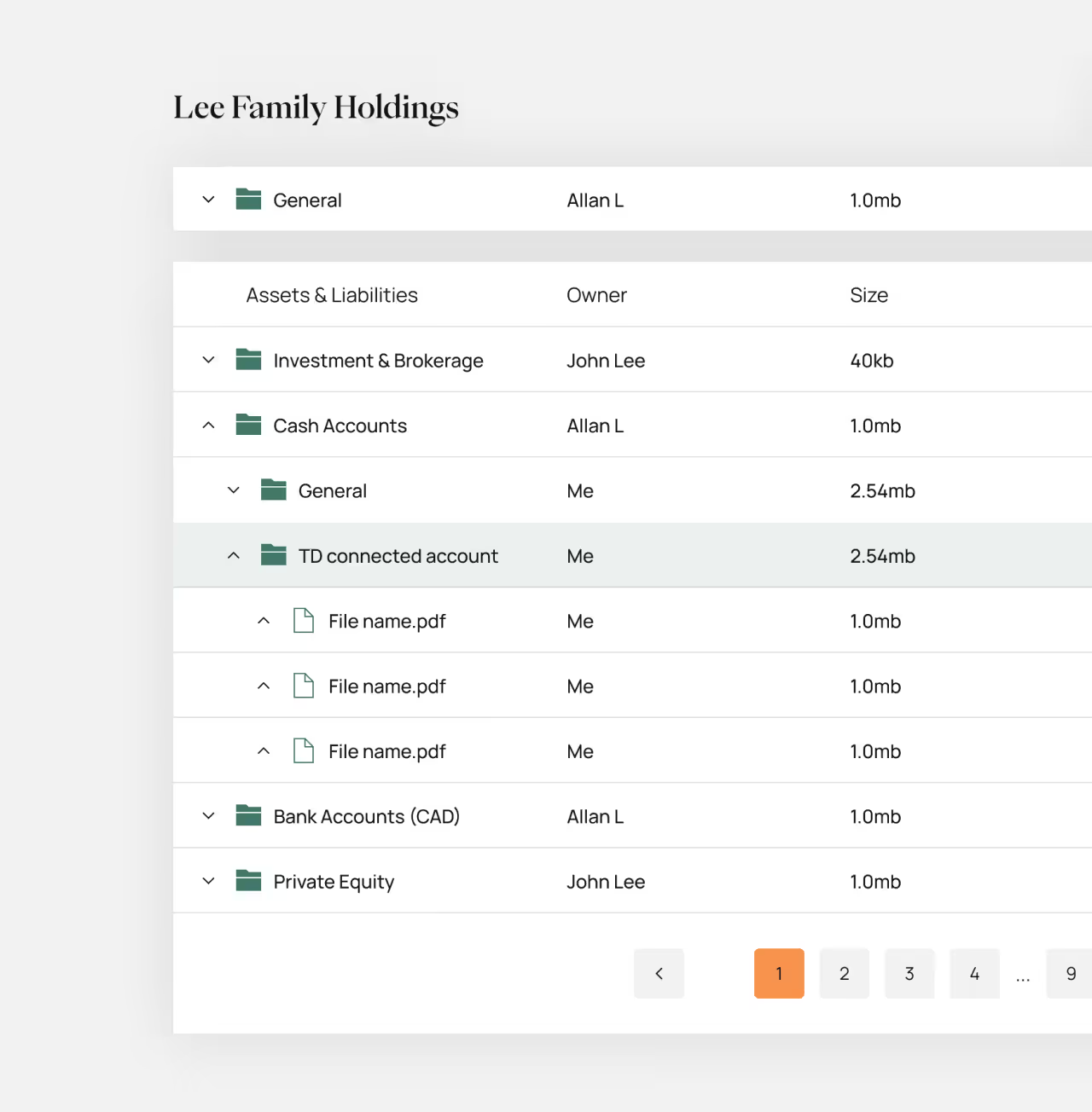

Securely store, organize, and manage all important documents by entity with role-based access controls. Upload financial statements, legal documents, and investment records with automated categorization and search capabilities. Save hours of document hunting—stakeholders can instantly access and review any document across all entities and assets.

.png)

.png)

MyFO

Advisors spend 60% of their time on KYC instead of clients.

Bank-level Security

.avif)

SOC ll Certified

- Access Log Management

- Automated Account Management

- Data Access Controls

- Single Sign-On (SSO)

- Least Privilege Access

- Password Management

- Password Security Standards

- Session Termination Protocols

- System Use Notifications

- Hosted on Amazon Web Services (AWS)

- Encryption Key Access Restricted

- Intrusion Detection Systems (IDS) in Place

- Log Management Implemented

- Restricted Production Application Access

- Restricted Production Database Access

- Restricted Production Network Access

- Enforced Encrypted Remote Access

- Unique Account Authentication

- Audit Logging

- Data Backup Protocols

- Multi-Factor Authentication (MFA)

- Role-Based Access Control (RBAC)

- Real-Time Alert Response

- Data Loss Prevention (DLP)

- Event & Audit Log Management

- Intrusion Prevention System (IPS)

- SOC 2 Compliance

- Regular Risk Assessments

- Third-Party Risk Management

- Employee Privacy Training

- Phishing Awareness Training

- Role-Based Security Training

- Security Awareness Programs

.svg)

.avif)

.avif)

.avif)